Insurance Underwriters

Where Would You Like to Go Next?

Or, Explore This Profession in Greater Detail...

What does this snowflake show?

What's this?

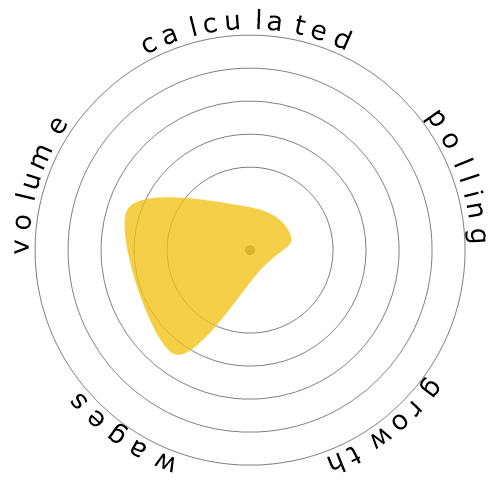

We rate jobs using four factors. These are:

- Chance of being automated

- Job growth

- Wages

- Volume of available positions

These are some key things to think about when job hunting.

People also viewed

Calculated automation risk

Imminent Risk (81-100%): Occupations in this level have an extremely high likelihood of being automated in the near future. These jobs consist primarily of repetitive, predictable tasks with little need for human judgment.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted that it's probable this occupation will be automated. This assessment is further supported by the calculated automation risk level, which estimates 83% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Insurance Underwriters will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is shown where there are enough votes to produce meaningful data. It displays user poll results over time, providing a clear indication of sentiment trends.

Sentiment over time (yearly)

Growth

The number of 'Insurance Underwriters' job openings is expected to decline 4.0% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Insurance Underwriters' was $77,860, or $37 per hour

'Insurance Underwriters' were paid 62.0% higher than the national median wage, which stood at $48,060

Wages over time

Volume

As of 2023 there were 101,310 people employed as 'Insurance Underwriters' within the United States.

This represents around 0.07% of the employed workforce across the country

Put another way, around 1 in 1 thousand people are employed as 'Insurance Underwriters'.

Job description

Review individual applications for insurance to evaluate degree of risk involved and determine acceptance of applications.

SOC Code: 13-2053.00

Comments (8)

I am considering entering insurance underwriting because claims were very bad, I must say.

Would you say that computer automation is taking over all areas of underwriting (commercial underwriting, property & casualty underwriting, etc.)? I do hear that it is taking personal insurance by storm.

Also, I am REALLY trying hard to find similar jobs to underwriting/insurance in case underwriting doesn't work out.

I'm looking at cost estimating (outside of construction), property assessment, and budget analysis. According to the Bureau of Labor Statistics, you don't necessarily need a business or finance degree to go into these fields (I took several traditional/core business classes in school, and I also majored in a field much like "business psychology" - organizational development, which was in the business school).

Do you have any alternatives that you plan to explore in case you have to leave underwriting? Do you think any of the ones that I mentioned are feasible alternatives?

Thank you,

Carl Daniel

Do you mean to say that this definition removes the need for an underwriter? - "Review individual applications for insurance to evaluate the degree of risk involved and determine the acceptance of applications."

Oh, sorry, I just realized that you mentioned that this definition only applies to line underwriting, and that automation will decrease the need for line underwriters.

Thank you for clarifying that there are two types of underwriting - I wasn't aware of that. Underwriting is the only field in insurance that interests me, but I'm not into sales. I've been working in claims (and subrogation) for years, but it's not my cup of tea.

Since I don't have the educational background to be an actuary, underwriting is pretty much the only option left for me.

I've never heard of staff underwriting before - unfortunately, working in claims didn't teach me much about underwriting.

It seems like staff underwriting is the future of employment in underwriting.

You mentioned that commercial insurance/underwriting is hard to predict due to the constantly evolving and complex nature of insurance.

I'm considering getting my Associates in Commercial Underwriting while I search for a job in underwriting.

What do you think about the future of employment in commercial underwriting? Do you think there's any hope for cautious optimism, especially for staff underwriters in commercial underwriting?

Thank you,

Carl Daniel

Reply to comment