Where Would You Like to Go Next?

Or, Explore This Profession in Greater Detail...

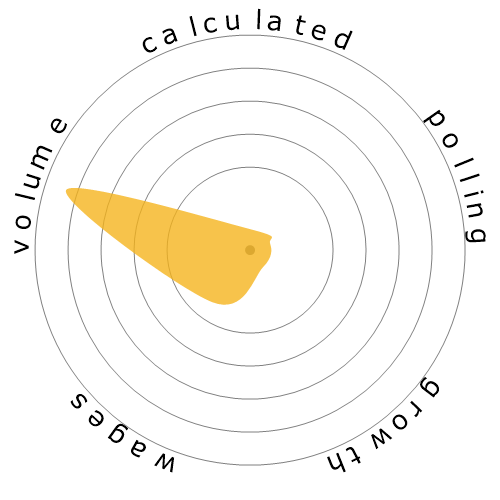

What does this snowflake show?

What's this?

We rate jobs using four factors. These are:

- Chance of being automated

- Job growth

- Wages

- Volume of available positions

These are some key things to think about when job hunting.

People also viewed

Calculated automation risk

Imminent Risk (81-100%): Occupations in this level have an extremely high likelihood of being automated in the near future. These jobs consist primarily of repetitive, predictable tasks with little need for human judgment.

More information on what this score is, and how it is calculated is available here.

User poll

Our visitors have voted that it's very probable this occupation will be automated. This assessment is further supported by the calculated automation risk level, which estimates 100% chance of automation.

What do you think the risk of automation is?

What is the likelihood that Bookkeeping, Accounting, and Auditing Clerks will be replaced by robots or artificial intelligence within the next 20 years?

Sentiment

The following graph is shown where there are enough votes to produce meaningful data. It displays user poll results over time, providing a clear indication of sentiment trends.

Sentiment over time (yearly)

Growth

The number of 'Bookkeeping, Accounting, and Auditing Clerks' job openings is expected to decline 5.0% by 2033

Total employment, and estimated job openings

Updated projections are due 09-2025.

Wages

In 2023, the median annual wage for 'Bookkeeping, Accounting, and Auditing Clerks' was $47,440, or $23 per hour

'Bookkeeping, Accounting, and Auditing Clerks' were paid 1.3% lower than the national median wage, which stood at $48,060

Wages over time

Volume

As of 2023 there were 1,501,910 people employed as 'Bookkeeping, Accounting, and Auditing Clerks' within the United States.

This represents around 1.0% of the employed workforce across the country

Put another way, around 1 in 101 people are employed as 'Bookkeeping, Accounting, and Auditing Clerks'.

Job description

Compute, classify, and record numerical data to keep financial records complete. Perform any combination of routine calculating, posting, and verifying duties to obtain primary financial data for use in maintaining accounting records. May also check the accuracy of figures, calculations, and postings pertaining to business transactions recorded by other workers.

SOC Code: 43-3031.00

Comments (12)

Consequently, the assistance of bookkeeping, accounting, and auditing clerks will still be necessary for accountants and auditors to manage AI accounting software effectively. Clerks' understanding of accounting principles and attention to detail makes them ideal for this task. However, the future of clerical roles is expected to involve ongoing learning and expanding responsibilities, as these professionals will need to enhance their knowledge in Accounting, Auditing, and Artificial Intelligence (AI) to assist accountants and auditors in their new duties of managing, assessing, auditing, and certifying the inputs and outputs associated with AI accounting software.

While the current integration of AI and digital tools is not as widespread as it will be in the future, the workload on Accountants and Auditors already surpasses their current capacity. As AI systems become more prevalent, the task of overseeing the increasing volume of financial data they generate will become even more demanding. AI and digitization have the potential to capture a significantly higher number of financial transactions compared to the present scenario. Consequently, Accountants will increasingly focus on auditing AI’s inputs and outputs, necessitating their clerks to enhance their support to streamline these processes effectively.

it'd just be for the tricky scenarios that having a human would be valuable.

And yet I seem to be getting more clients.

I understand the logic and I don't disagree with it -- but that doesn't seem to be the way it's shaking out.

Reply to comment